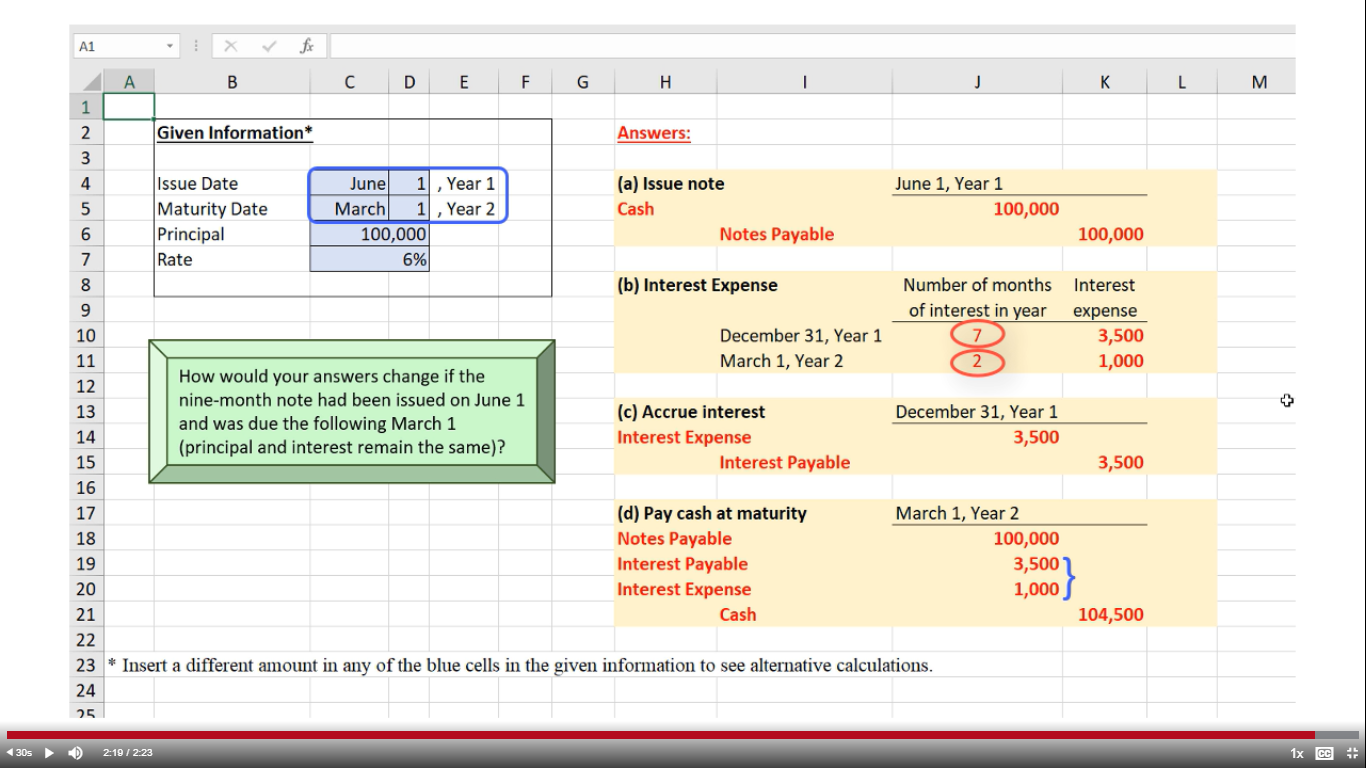

If the preceding example had a maturity date at other than the December 31 year-end, the $1,000 of total interest expense would need to be recorded partially in one period and partially in another. In the above example, the principal amount of the note payable was 15,000, and interest at 8% was payable in addition for the term of the notes. Sometimes notes payable are issued for a fixed amount with interest already included in the amount. In this case the business will actually receive cash lower than the face value of the note payable. The long term-notes payable are very similar to bonds payable because their principle amount is due on maturity but the interest thereon is usually paid during the life of the note.

The article also includes other Excel templates that you can use in your business. In examining this illustration, one might wonder about the order in which specific current obligations are to be listed. One scheme is to list them according to their due dates, from the earliest to the latest. Another acceptable alternative is to list them by maturity value, from the largest to the smallest. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

The debit of $2,500 in the interest payable account here is to eliminate the payable that the company has previously recorded at period-end adjusting entry on December 31, 2020. If the company does not make this journal entry, both total expenses on the income statement and total liabilities on the balance sheet will be understated by $2,500 as of December 31, 2020. The notes payable is an agreement that is made in the form of the written notes with a stronger legal claim to assets than accounts payable. The company usually issue notes payable to meet short-term financing needs.

The purpose of issuing a note payable is to obtain loan form a lender (i.e., banks or other financial institution) or buy something on credit. In this journal entry, interest expenses is a debit entry, and interest payable is a credit entry, as a portion of it is yet to be paid. The cash account is a credit entry as the amount will decrease, given the pending interest payment.

On February 1, 2019, the company must charge the remaining balance of discount on notes payable to expense by making the following journal entry. A zero-interest-bearing note (also known as non-interest bearing note) is a promissory note on which the interest rate is not explicitly stated. When a zero-interest-bearing note is issued, the lender lends to the borrower an amount less than the face value of the note. At maturity, the borrower repays to lender the amount equal to face vale of the note. Thus, the difference between the face value of the note and the amount lent to the borrower represents the interest charged by the lender. In this journal entry, the company debits the interest payable account to eliminate the liability that it has previously recorded at the period-end adjusting entry.

Notes payable is an instrument to extend loans or to avail fresh credit in the company. It must charge the discount of two months to expense by making the following adjusting entry on December 31, 2018. Negative agreements require borrowers to pay interest less than the applicable interest charges, thereby adding the remaining amount to the principal balance. Though choosing this option helps people refrain from paying more as interest when inconvenient, the same adds up to the total amount to be repaid in the long run, increasing the burden. Amortized, on the other hand, is whereby a borrower pays a fixed monthly amount, including both principal and interest portions. Here, the major portion is paid towards the principal and the rest towards applicable interest.

The face of the note payable or promissory note should show the following information. In the cash conversion cycle, companies match the payment dates with Notes receivables, ensuring that receipts are made before making the payments to the what is considered a qualified education expense and what can i claim suppliers. The following entry is required at the time of repayment of the face value of note to the lender on the date of maturity which is February 1, 2019. National Company prepares its financial statements on December 31 each year.

These notes are negotiable instruments in the same way as cheques and bank drafts. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under the accrual method of accounting, the company will also have another liability account entitled Interest Payable. In this account, the company records the interest it has incurred but has not paid as of the end of the accounting period. The discount on notes payable in above entry represents the cost of obtaining a loan of $100,000 for a period of 3 months. Therefore, it should be charged to expense over the life of the note rather than at the time of obtaining the loan.

In scenario 2, the principal is being reduced at the end of each year, so the interest will decrease due to the decreasing balance owing. In scenario 3, there is an immediate reduction of principal because of the first payment of $1,000 made upon issuance of the note. The remaining four payments are made at the beginning of each year instead of at the end. This results in a faster reduction in the principal amount owing as compared with scenario 2. A note payable is an unconditional written promise to pay a specific sum of money to the creditor, on demand or on a defined future date.

On this date, National Company must record the following journal entry for the payment of principal amount (i.e., $100,000) plus interest thereon (i.e., $1,000 + $500). Notes Payable resembles any loan, which binds borrowers and lenders against payment and repayment liabilities. A general ledger is a book of accounts that provides a detailed record of all of a business’s financial transactions.

The short term notes payable are classified as short-term obligations of a company because their principle amount and any interest thereon is mostly repayable within one year period. They are usually issued for purchasing merchandise inventory, raw materials and/or obtaining short-term loans from banks or other financial institutions. The short-term notes may be negotiable which means that they may be transferred in favor of a third party as a mode of payment or for the settlement of a debt. The short-term notes are reported as current liabilities and their presence in balance sheet impacts the liquidity position of the business. It is common knowledge that money borrowed from a bank will accrue interest that the borrower will pay to the bank, along with the principal. The present value of a note payable is equivalent to the amount of money deposited today, at a given rate of interest, which will result in the specified future amount that must be repaid upon maturity.