On the other hand, a comparatively low D/E ratio may indicate that the company is not taking full advantage of the growth that can be accessed via debt. Simply put, the higher the D/E ratio, the more a company relies on debt to sustain itself. Liabilities are items or money the company owes, such as mortgages, loans, etc. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. It’s easy to get started when you open an investment account with SoFi Invest.

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Pete Rathburn is xero odbc driver a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts. Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop.

Overall, the D/E ratio provides insights highly useful to investors, but it’s important to look at the full picture when considering investment opportunities. These industry-specific factors definitely matter when it comes to assessing D/E. When assessing D/E, it’s also important to understand the factors affecting the company. For this reason, it’s important to understand the norms for the industries you’re looking to invest in, and, as above, dig into the larger context when assessing the D/E ratio.

The other important context here is that utility companies are often natural monopolies. As a result, there’s little chance the company will be displaced by a competitor. As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context. Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering.

Sectors requiring heavy capital investment, such as industrials and utilities, generally have higher D/E ratios than service-based industries. Understanding these distinctions is crucial for accurately interpreting a company’s financial obligations and overall leverage. A higher ratio suggests that the company uses more borrowed money, which comes with interest and repayment obligations. Conversely, a lower ratio indicates that the company primarily uses equity, which doesn’t require repayment but might dilute ownership. When looking at a company’s balance sheet, it is important to consider the average D/E ratios for the given industry, as well as those of the company’s closest competitors, and that of the broader market. The quick ratio measures the capacity of a company to pay its current liabilities without the need to sell its inventory or acquire additional financing.

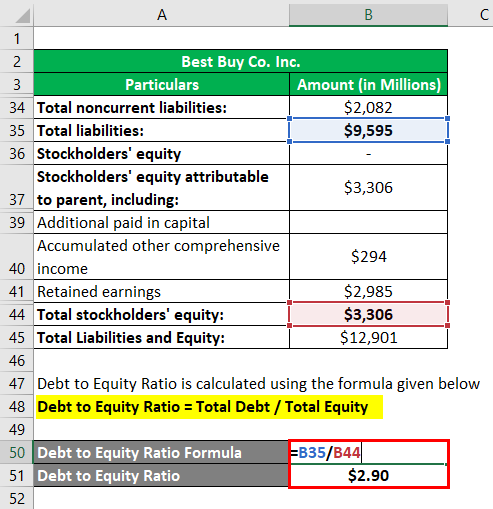

To find a companys leverage, you need to figure out their total capital, which includes all debt with interest and the shareholder’s equity, which can be in the form of stocks. The financial statement discloses assets and liabilities as well as the shareholder’s equity, which are the assets left after all debts have been paid. Reviewing it, along with any additional financial information, can give a well-rounded picture of the companys financial stability. This ratio indicates how much debt a company is using to finance its assets compared to equity. A high ratio may suggest higher financial risk, while a low ratio indicates less risk.

Please independently evaluate and verify the accuracy of any such output for your own use case. When investing as a beginner, market conditions, such as whether its a bull vs. bear market can have an impact on the decisions you make, so it’s important to gain insight on how you can be affected. However, because the company only spent $50,000 of their own money, the return on investment will be 60% ($30,000 / $50,000 x 100%). If the company uses its own money to purchase the asset, which they then sell a year later after 30% appreciation, the company will have made $30,000 in profit (130% x $100,000 – $100,000). For this to happen, however, the cost of debt should be significantly less than the increase in earnings brought about by leverage. It is a problematic measure of leverage, because an increase in non-financial liabilities reduces this ratio.[3] Nevertheless, it is in common use.

Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt. The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, which allows easier budgeting and financial planning. However, in this situation, the company is not putting all that cash to work. Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments.

Financial leverage simply refers to the use of external financing (debt) to acquire assets. With financial leverage, the expectation is that the acquired asset will generate enough income or capital gain to offset the cost of borrowing. A high debt to equity ratio means that the company is highly leveraged, which in turn puts it at a higher risk of bankruptcy in the event of a decline in business or an economic downturn. A low debt to equity ratio, on the other hand, means that the company is highly dependent on shareholder investment to finance its growth. If a company is using debt to finance its growth, this can potentially provide higher return on investment for shareholders, since the company is generating profits from other people’s money. A high debt to equity ratio means that a company is highly dependent on debt to finance its growth.

Plans are self-directed purchases of individually-selected assets, which may include stocks, ETFs and cryptocurrency. Plans are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are created using defined, objective criteria based on generally accepted investment theory; they are not based on your needs or risk profile. You are responsible for establishing and maintaining allocations among assets within your Plan. See our Investment Plans Terms and Conditions and Sponsored Content and Conflicts of Interest Disclosure.